Quick Answer: How Much to Offer on a House That Needs Work?

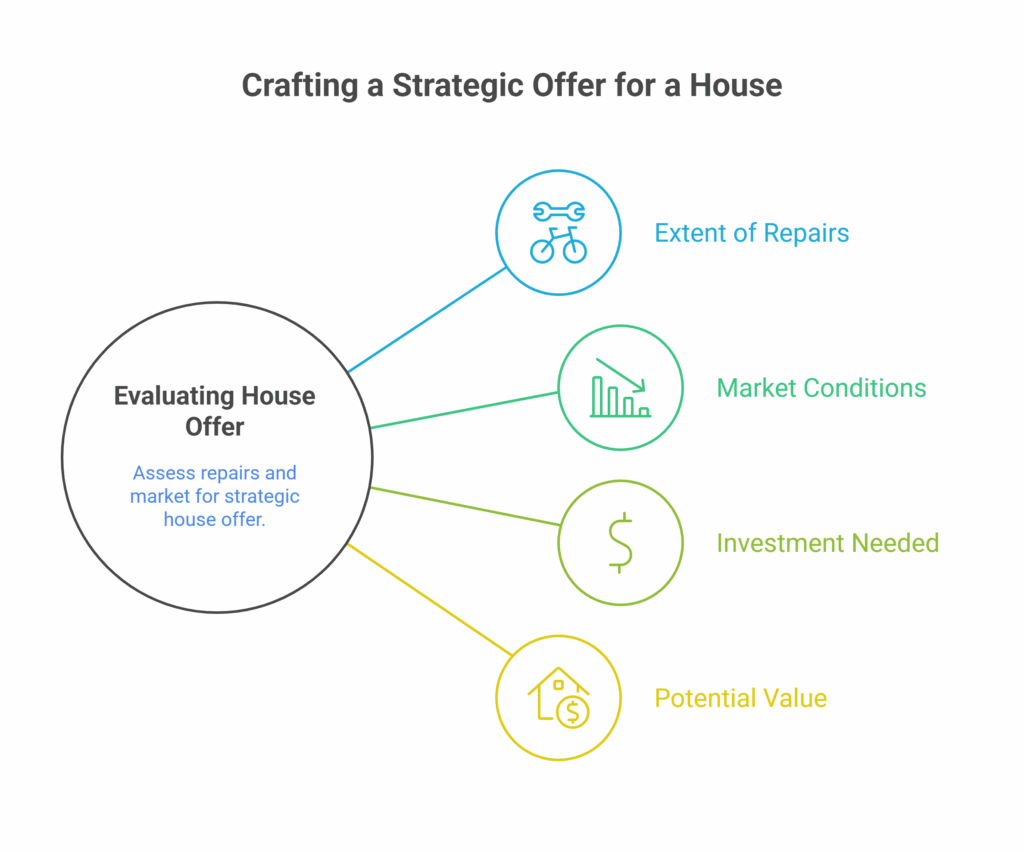

When deciding How Much to Offer on a House That Needs Work?, the key is balancing the purchase price with the cost of repairs and potential resale value. Start by estimating the property’s after-repair value (ARV) based on comparable homes in good condition. Next, calculate the cost of necessary renovations, then subtract that amount plus a buffer for unexpected expenses from the ARV. This method, often called the “70% rule,” suggests you shouldn’t pay more than 70% of the ARV minus repairs. Also, factor in your budget, financing, and how much time and effort you’re willing to invest.

In short, knowing How Much to Offer on a House That Needs Work? means combining smart math with a realistic look at your goals.

Now let’s dive deeper.

1. Assess the Home’s Market Value (If It Were in Good Condition)

Before making any offer, you need to understand what the home would be worth if it were in top shape. This is known as the After Repair Value (ARV). You can do this by comparing the house with other recently sold homes in the area with similar square footage, layout, and amenities but in better condition. Online real estate platforms or a real estate agent can help determine the ARV.

Let’s say a fully renovated home in the neighborhood is worth $300,000. That’s your ARV.

2. Estimate the Repair Costs

Once you have the ARV, the next step is to get a realistic estimate of how much it will cost to bring the home up to that standard. You can either:

- Hire a contractor for a professional estimate

- Use general guidelines (e.g., $20–$60 per square foot depending on condition)

If the house needs a new roof, HVAC system, plumbing, flooring, and kitchen/bath upgrades, your repair costs might total $75,000 or more. Don’t forget to include a buffer for unexpected expenses usually 10-20% of the total renovation budget.

3. Use the 70% Rule (Popular with Investors)

This formula helps calculate a fair offer while still leaving room for profit or future equity:

Maximum Offer = (ARV x 70%) – Repair Costs

Using the earlier example:

- ARV: $300,000

- 70% of ARV: $210,000

- Estimated Repairs: $75,000

- Maximum Offer = $210,000 – $75,000 = $135,000

This ensures you don’t overpay while still making room for repairs, closing costs, and potential resale value. It’s the same formula many investors use—including us, because we buy houses in Texas and often analyze fixer-uppers with this exact method.

4. Factor in Holding and Selling Costs

If you plan to resell, you must also consider holding costs (property taxes, insurance, utilities) and selling costs (agent commissions, closing fees). Even if you’re buying to live in, holding costs during renovation can add up. Subtract these from your offer or at least budget for them in your overall financial plan.

5. Be Realistic About Your Skill Level and Timeline

DIY renovations can save money, but only if you know what you’re doing. Otherwise, mistakes can cost more in the long run. If you’ll be hiring professionals, add those costs in. And remember, extensive renovations mean time—time during which you’ll be paying the mortgage, taxes, and possibly rent elsewhere.

6. Consider Negotiating Other Terms

Sometimes sellers are more flexible with terms than price. You could:

- Ask for closing costs to be covered

- Request a longer inspection period

- Propose a rent-back agreement if they need time to move

Being creative with terms can help bridge gaps between offer and asking price, especially for distressed properties.

Final Thoughts

Buying a fixer-upper can be incredibly rewarding—but only if you offer the right price. Do your research, run the numbers, and don’t let emotions get in the way of logic. Whether you’re planning to live in the home or flip it, the offer you make will determine your financial outcome.

At the end of the day, understanding local markets and repair values is crucial. That’s exactly what we specialize in—we buy houses in Texas and can help you evaluate, estimate, and navigate the buying process for homes in any condition.

Call us anytime at 713-561-5162 or connect with us on our website and we’ll lay out all of your options for your specific situation.