Quick Answer: What Are Good Funds in Real Estate?

When it comes to real estate investing, one common question is: What Are Good Funds in Real Estate? The answer often depends on your financial goals, risk tolerance, and the type of exposure you want. Generally, good funds in real estate include Real Estate Investment Trusts (REITs), real estate mutual funds, and exchange-traded funds (ETFs) that focus on property markets.

These options allow investors to benefit from real estate returns without directly owning or managing property. Good funds are typically diversified, professionally managed, and focus on sectors like commercial properties, residential housing, or mixed-use developments.

Now let’s dive deeper.

Understanding Good Funds in Real Estate

In real estate, good funds refer to money that i immediately available for withdrawal by the title company, escrow agent, or attorney handling the closing. These funds must be cleared, verified, and accessible before a transaction can close.

The concept ensures that all parties—especially sellers—can trust that the payment is legitimate, available, and not subject to being reversed.

For example, if you’re selling your house and the buyer provides a personal check at closing, that check could bounce or take days to clear. With good funds, this risk is eliminated because the money is already verified and accessible.

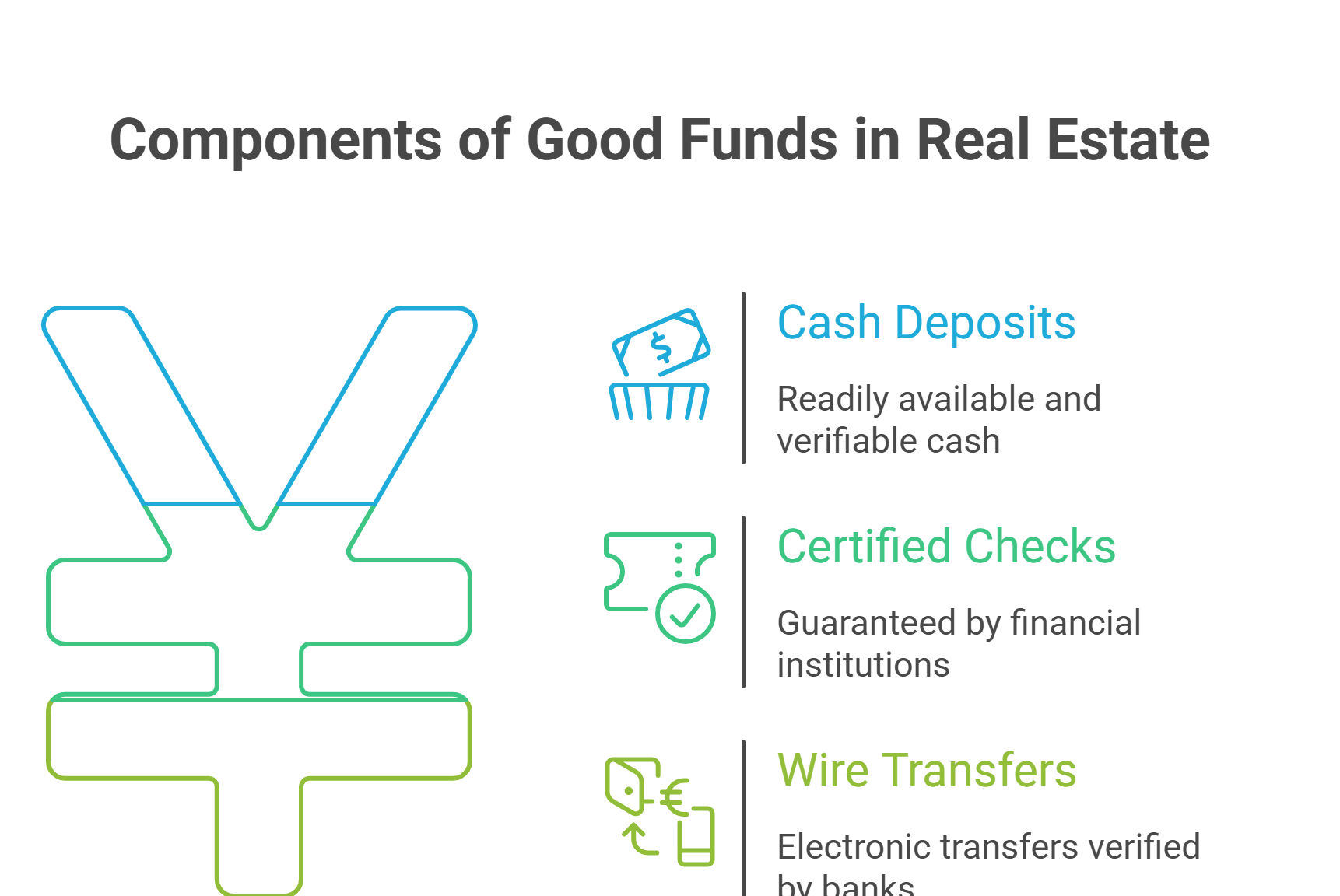

Types of Good Funds

Different states have slightly different rules about what counts as good funds, but the most common forms include:

- Wire Transfers

- The most preferred and common form of good funds.

- Money is sent directly from the buyer’s bank to the title company’s escrow account.

- Funds are usually available the same day, but the exact timing can depend on the bank’s processing cutoffs.

- Cashier’s Checks or Certified Checks

- Issued directly by the bank, guaranteed by bank funds.

- They are considered secure because the bank has already withdrawn the money from the issuer’s account.

- Electronic Funds Transfer (EFT)

- Similar to a wire transfer but often used for smaller amounts or within the same bank.

- Cash (in limited situations)

- While technically considered good funds, most title companies discourage or refuse large cash transactions due to fraud and security concerns.

- Bank Drafts

- Less common but acceptable in certain states if issued directly by the bank.

Why Good Funds Matter?

The good funds rule exists to protect all parties involved in a real estate transaction. Without it, sellers could unknowingly transfer property before receiving actual payment, or title companies could release funds before they are secure.

Key benefits of using good funds include:

- Fraud Prevention: Reduces the risk of fake checks or insufficient funds.

- Faster Closings: With verified funds, closings proceed without delays caused by waiting for checks to clear.

- Legal Compliance: Many states, including Texas, have strict good funds laws for real estate transactions.

The Good Funds Law in Texas

In Texas, the Texas Good Funds Law is outlined in the Texas Insurance Code and Title Insurance regulations. It requires that title companies receive good funds before disbursing any money related to a closing.

Acceptable good funds in Texas typically include:

- Wire transfers

- Cashier’s checks

- Certified checks

- Electronic payment methods approved by the title company

Personal checks are generally not accepted for amounts over a certain limit—usually $1,500—because they take time to clear.

How Good Funds Affect Buyers and Sellers?

Whether you’re buying or selling, good funds impact your closing experience.

For Buyers:

- You must ensure the funds for your purchase are in the form required by the title company.

- If you’re using a lender, the bank typically wires the money directly.

- Delays in wiring or mistakes in the transfer can delay closing.

For Sellers:

- You can rest assured that once you sign over the deed, the funds you receive are secure and immediately available.

- No risk of payment reversal or delays.

Tips for Handling Good Funds Properly

- Communicate Early

- Ask your title company in advance what forms of payment they accept as good funds.

- Watch for Wire Fraud

- Always verify wiring instructions with the title company by phone before sending funds.

- Plan for Transfer Times

- Banks have daily cut-off times for wire transfers. Missing the deadline could delay your closing.

- Avoid Last-Minute Changes

- Stick to your agreed-upon payment method to avoid unnecessary verification delays.

Common Misconceptions About Good Funds

- “A personal check works if I have the money in my account.”

Not necessarily—until the check clears, it’s not considered good funds. - “Cash is always accepted.”

Most title companies avoid large cash transactions due to legal and security concerns. - “I can bring the funds on closing day without preparation.”

This can be risky; banks may need notice to issue cashier’s checks or process wires.

Good Funds and Real Estate Investors

For real estate investors—especially those in competitive markets like Texas—understanding good funds can make the difference between winning and losing a deal.

If you work with companies like we buy houses in Texas, transactions often move quickly. These companies are familiar with good funds requirements and typically use wire transfers to close deals fast, giving sellers peace of mind.

Final Thoughts

Good funds are the backbone of secure real estate transactions. Whether you’re buying your first home, selling an investment property, or working with a quick-purchase company, ensuring that all payments meet the good funds requirement will protect you from delays, fraud, and legal complications.

In Texas especially, the good funds law helps both buyers and sellers feel confident during closing. If you prepare your payment method early, verify transfer details, and work with reputable professionals, you can expect a smooth and stress-free transaction.

If you’re looking to sell your home quickly and safely, companies like we buy houses in Texas can guide you through the process while ensuring all good funds requirements are met.

Call us anytime at 713-561-5162 or connect with us on our website and we’ll lay out all of your options for your specific situation.