Quick Answer: What Happens to Escrow When You Sell?

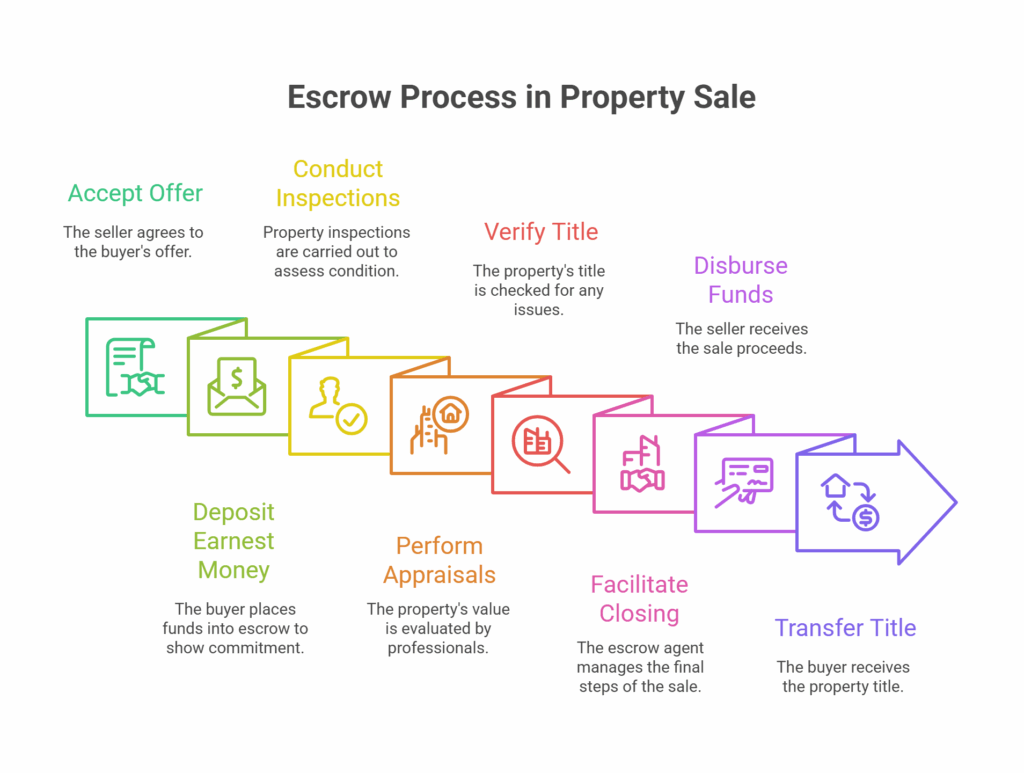

When selling a home, many sellers wonder, “What Happens to Escrow When You Sell?” Escrow is essentially a neutral account that holds funds and documents until all conditions of the sale are met. Once the buyer’s financing, inspections, and title clear, the escrow company distributes the funds accordingly.

For the seller, this means any outstanding mortgage, fees, or liens are paid off first, and the remaining balance is transferred as profit. In short, escrow ensures both parties fulfill their obligations and provides a secure, transparent process so the sale closes smoothly without financial surprises.

Now let’s dive deeper.

What Exactly Is Escrow?

Put simply, an escrow is a neutral third-party account that holds money and documents until all the conditions of a real estate transaction are met. Think of it as a safety locker ensuring neither the buyer nor seller is cheated.

A property seller time in escrow gave assurances. When a home is sold, escrow assures that the purchaser’s money is secure, title documents are in order, and no one is legally incapable of transferring the ownership rights. Without escrow, real estate deals would feel like the Wild West: risky, hazardous, and quite unpredictable.

Whose Responsibility Is An Escrow?

Usually, an escrow officer or a title company would administer the process. They act as neutral intermediaries who oversee that both parties perform their duties under the terms of the contract. They don’t work for the buyer or seller; they work for the contract.

For sellers, it can feel like an invisible shield, ensuring that when they give over the property, they’re not left without any cash in hand. For buyers, it makes sure their money is protected until they really own the home.

What happens to your escrow account after you sell?

Now, here’s the most interesting thing about the whole transaction: most homeowners will have an escrow account associated with their mortgage. The lender uses this account for collecting and disbursing payments for property taxes and homeowner’s insurance. So, what happens to this escrow when you go ahead with selling a house?

1. Your Mortgage Is Paid Off

The first thing escrow does is to clear the outstanding debts against the title. Once a buyer deposits the funds, the escrow will take part of it to pay off whatever existing mortgage you have on this property to full satisfaction. You cannot transfer title of the property until your lender acknowledges that the loan is fully paid.

2. Property Taxes and Insurance Are Balanced Out

If your mortgage company has been holding money for property taxes and insurance in your escrow account, you might want to know what happens to that balance. The good thing is that once your loan is paid off, lenders typically remit a check to you for whatever balance remains in the escrow account. This can occur a few weeks after closing.

3. Settle Fees, Commissions, and Liens

Those funds are then used for agent commissions, title fees, and any liens on the property. Basically, it acts as a clearinghouse for the financial aspects of your house, making sure all bills connected with your house are paid before you walk away with your profits.

4. Net Proceeds to You

Once all the other costs and payouts have been settled, the remainder, representing the net proceeds from your sale, is payable to you. It can be provided in the form of a check or by direct deposit.

Now, if you are thinking… “I want to sell my house fast Cypress“, escrow basically guarantees not just a quick closing but also a safe deposit of your funds.

How Long Does Escrow Take When Selling?

Depending on the type, a transaction escrow can hold for from 30 to 45 days. On the other hand, should both sides rush—or if you sell just to a cash buyer—escrow is said to be able to close within seven to 10 days.

Elements influencing the timeline:

- Buyer financing: Mortgage approval generally takes longer than cash purchase.

- Inspections and appraisals: If any problems are found, it can become cause of delay.

- Title issues: Disputes or liens on a property need to be resolved before close.

- Negotiations: Time is added if either party wishes for repairs or credits.

In case the seller wishes to move fast on a sale, an investor buyer will drastically cut escrow.

A Seller Escape Through Escrow

But escrow is not just for protecting buyers; it protects sellers equally. Here’s how it does:

- Guarantees payment: You won’t be asked to sign the rights to your home without first knowing the funds have been secured.

- Disputes are settled: Should there be a dispute over the transaction, escrow holds the funds and documents until the dispute is resolved.

- Manages the paperwork: Title transfers, if necessary, must be recorded by escrow in the legal labyrinth.

- Manages accounting issues: Ensures that a buyer is not cheated on prepaid taxes, HOA fees, or insurance.

Say another way, the escrow system acts as a safety net for your transaction.

Commonly Asked Questions by Sellers Regarding Escrow

Do I get an immediate refund from escrow?

No. Usually your lender sends the refund within 30–60 days after your mortgage has been fully paid.

Can escrow get canceled?

Inasmuch as the buyer’s financing collapses, or inspection issues fail to get resolved, escrow may get canceled. But the good news is you are protected–that is, your house doesn’t get transferred till everything is finalized.

What if I have to sell fast?

If time is of the essence and you say, “I want to sell my house fast in Cypress,” then try to work with cash buyers or investors who do not rely on traditional financing. Such activities could really cause delay to escrow.

Tips to Ensure a Smooth Escrow While Selling

- Be transparent about repairs and disclosures: An unexpected issue during the inspection can adversely affect escrow.

- Clean up liens upfront: Any unpaid debts attached to the property must be taken care of.

- Stay responsive: Quickly sign documents and provide requested information.

- Work with professionals: An experienced agent or an attorney in real estate will help keep you out of trouble.

- Know your net proceeds: Ask your escrow officer for a settlement statement prior to closing so you know how much money you will actually be putting in your pocket.

Why Does Escrow Matter More When Speed Counts?

If you’re relocating, having trouble with funds, or wish to make a quick sale, it might seem like a big hurdle-the escrow or security deposit- for other terms. Actually, these terms ensure that you securely sell. The key is in finding the right buyer.

Often, cash buyers and reputable investors close escrow in a flash time-wise-thus bypassing lengthy mortgage approvals and cumbersome technicalities. This is the most suitable way to sell my house fast Cypress without losing sleep over endless paperwork.

Final Words

Selling a house isn’t about finding a buyer, it’s about closing with confidence. Escrow is the system that makes sure everyone holds up their end of the deal, your mortgage is paid, your taxes are paid, and your profit is safely deposited into your bank account.

So, next time when you ask, “What happens to escrow when you sell?” think about the fact that it’s not just a box to click. It is your built-in protection for one of life’s greatest transactions.

Call us anytime at 713-561-5162 or connect with us on our website and we’ll lay out all of your options for your specific situation.