Quick Answer: How to Find a Lien on a Property?

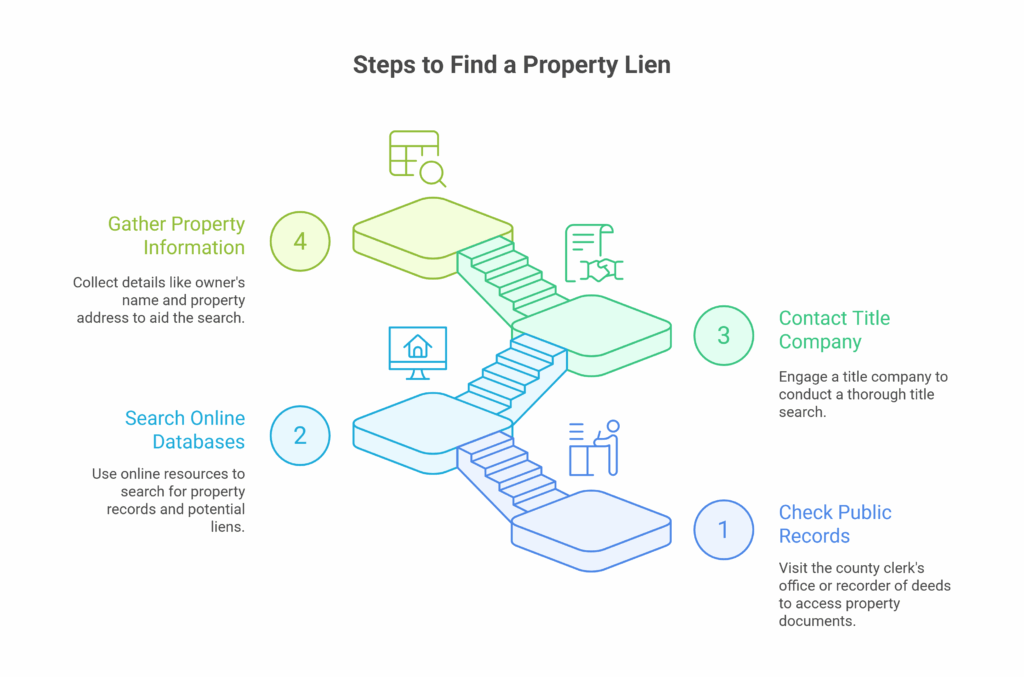

When it comes to real estate, surprises are fun only if they come in the form of a housewarming gift—not an unexpected lien. So, how to find a lien on a property? Start by checking public property records at the county recorder or assessor’s office where the property is located. Many counties also offer online search tools that let you look up liens with just the property address. You can also request a title search from a title company or real estate attorney for a more thorough check.

In short: a little due diligence now can save a lot of headaches later.

What is a Property Lien?

A property lien is a legal claim placed on a property by a creditor. It serves as a public notice that the property owner owes a debt, and the lien essentially secures that debt by using the property as collateral. If the debt remains unpaid, the creditor may eventually force a sale of the property to recover their money.

There are two broad categories of liens:

- Voluntary liens, such as a mortgage, which the homeowner agrees to.

- Involuntary liens, such as tax liens, judgment liens, or mechanics’ liens, imposed without the owner’s direct consent.

Why It’s Important to Check for Liens?

If you purchase a property with a lien, that lien doesn’t just go away—it becomes your responsibility. Liens can block a property’s sale, refinancing, or even its inheritance. In short, failing to identify a lien can lead to:

- Unexpected legal battles

- Foreclosure or forced sale

- Delays in closing a sale

- Reduced property value

This is why understanding how to find a lien on a property is not just useful—it’s absolutely essential.

Various Ways to Uncover a Lien Property

1. Check with the County Recorder or Assessor’s Office

One of the most direct and reliable ways to check for a lien is through the county recorder or assessor’s office in the county where the property is located.

Most counties maintain a public database of property records, including any recorded liens. You can usually do this:

- Online, through the official county website

- In person, by visiting the local office

- Via phone or email, if digital access is limited

You’ll need the property’s address or, in some cases, the Assessor’s Parcel Number (APN). Search for “lien,” “encumbrance,” or “recorded documents” to access the relevant records.

Example: If you’re checking a property in El Paso, you’d visit the El Paso County Clerk’s Office online or in person and search for recorded liens by address.

2. Hire a Title Company

Title companies specialize in property records and will conduct a title search on your behalf. This search will identify:

- Any outstanding liens

- Ownership history

- Legal encumbrances

- Property tax obligations

This is often done during the buying or selling process and is a common part of closing services. While it may cost a few hundred dollars, it’s a small price to pay compared to the risk of buying a lien-heavy property.

3. Consult a Real Estate Attorney

If you suspect a lien but can’t find it in public records—or you’re dealing with a complex real estate situation—consult a real estate attorney. They can dig deeper into records and may have access to legal databases not available to the public.

This is especially useful if:

- The lien is the result of a lawsuit or divorce settlement

- There’s confusion about lien priority (who gets paid first)

- You need help resolving the lien legally

4. Use Online Real Estate Tools and Databases

Some online real estate services like PropertyShark, DataTree, or even Zillow offer lien-related information as part of their property reports. These tools aggregate data from public and private sources and can give a quick snapshot of a property’s legal and financial status.

Keep in mind that:

- These platforms may require a subscription

- They’re best used for initial research, not final confirmation

5. Ask the Seller to Disclose All Known Liens

When buying a home, always ask the seller directly about any known liens or encumbrances. While sellers are legally required to disclose certain issues, not all will voluntarily mention liens unless prompted.

If you’re selling a property, it’s wise to run a title search beforehand to uncover any liens so you can resolve them in advance.

Common Types of Property Liens You Might Encounter

When learning how to find a lien on a property, it’s also helpful to understand what you’re looking for. Some common types of property liens include:

- Mortgage liens: Created when the owner takes out a home loan.

- Tax liens: Placed by the IRS or local government for unpaid taxes.

- Judgment liens: Resulting from lawsuits and court judgments.

- Mechanic’s liens: Filed by contractors or suppliers for unpaid work or materials.

- HOA liens: Issued by homeowners’ associations for unpaid dues or violations.

Each type of lien has different rules for enforcement and resolution, so once you identify a lien, it’s critical to understand the specifics.

How to Remove a Lien?

Once you find a lien, the next step—especially if you’re the property owner—is to remove or satisfy the lien. Options include:

- Paying off the debt

- Negotiating a settlement

- Disputing the lien in court if it’s invalid

- Requesting a lien release or satisfaction letter from the creditor

After the lien is resolved, ensure that the appropriate document is recorded with the county to officially clear the lien from the property’s title.

How Long Do Property Liens Last?

Lien duration depends on the lien type and the state’s laws. Some liens, like tax liens, can last indefinitely until satisfied. Others, like judgment liens, may expire after a set number of years but can often be renewed by the creditor.

That’s why even if a lien seems “old,” it’s still worth investigating thoroughly.

Final Thoughts

Knowing how to find a lien on a property is one of the smartest steps you can take in any real estate transaction. Whether you’re buying a dream home, evaluating an investment, or trying to settle legal matters on an inherited house, lien discovery is not optional—it’s essential.

Take advantage of public records, title professionals, and legal experts to ensure you’re not walking into a financial trap. And if you’re the homeowner, knowing about an existing lien early gives you the upper hand in resolving it quickly and avoiding delays.

Speaking of selling a home, if you’re looking to avoid complex issues like liens altogether and need a quick, straightforward sale, you might want to consider cash home buyers. Many of these services handle title searches for you and can close fast, even on homes with title issues.

If you’re saying to yourself, “I need to sell my house fast El Paso”, working with a professional home-buying service that understands the local market can help you bypass the usual stress—no matter what’s attached to the title.

Call us anytime at 713-561-5162 or connect with us on our website and we’ll lay out all of your options for your specific situation.