Quick Answer: How to Stop a Foreclosure in Texas?

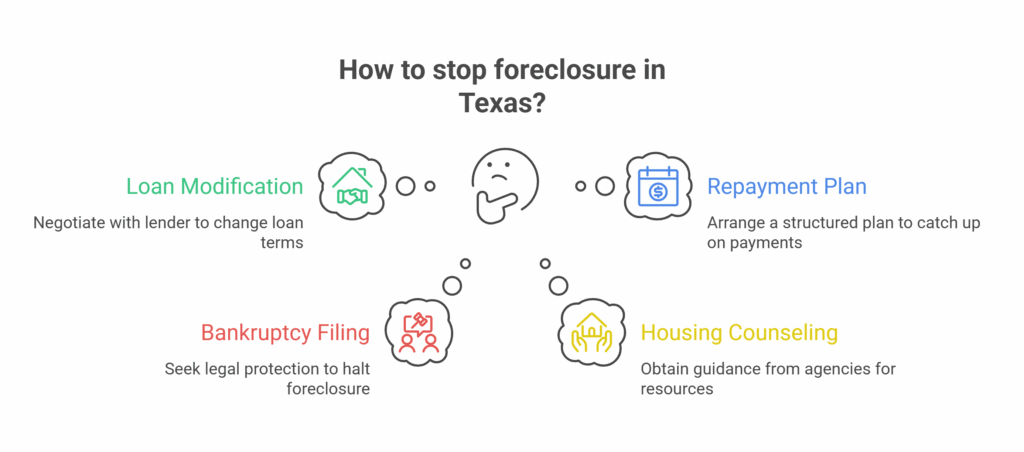

How to Stop a Foreclosure in Texas? Homeowners have several legal and financial options to prevent losing their property. These include negotiating a loan modification, setting up a repayment plan, or requesting forbearance directly with the lender. Filing for bankruptcy can also temporarily halt foreclosure proceedings while debts are reorganized.

Seeking help from a housing counselor or attorney ensures the right steps are taken. Acting quickly is critical, as Texas foreclosures move faster than in many other states.

Now let’s dive deeper.

Understanding Foreclosure in Texas

Foreclosure approaches about when you cannot fulfill your mortgage terms and the lender recovers the owed amount by seeking a legal right over your property. In Texas, the majority of foreclosures are non-judicial, and as such, the lender can proceed without a time-consuming court hearing. Due to the quick schedule, it’s essential to know your rights and possibilities early enough. Once the decision is made to consider a way to prevent foreclosure in Texas, it is essential to understand the details of the procedure, including reinstatement time and the notice requirements.

- Types of Foreclosure: Texas largely employs non-judicial foreclosure methods. That is to say, if you default on a payment, the lender may start the foreclosure process without going to court.

- Terminology: Important words include “reinstatement,” “loan modification,” and “forbearance.” Reinstatement allows you to catch up on your late payments, while a loan modification can change your payment terms so your monthly payments are more manageable.

- Timeline: You usually have a short timeframe (usually around 20 days following a default notice) within which to take remedial action. Speed is of the essence.

Assessing Your Financial Situation

You must have a good idea of your financial situation before you can make the best decision on how to avoid foreclosure. Begin by collecting all relevant papers—bank statements, mortgage papers, and any letters from your lender. Assessing your present financial condition will enable you to decide if you can catch up on missed payments or if you must explore other forms of relief. It is important to contact your lender early; lenders tend to favor negotiating a solution over going forward with a foreclosure. Being proactive is the key to learning how to prevent a foreclosure in Texas.

Exploring Your Options

There are several effective strategies available to stop foreclosure. Each option has its advantages and is best suited for different financial situations:

1. Loan Modification

Loan modification is the act of negotiating a new mortgage terms agreement with your lender. It may include decreasing your interest rate, increasing your repayment term, or even shaving down your principal balance. With a successful modification, your payments become more manageable and are among the major options for individuals looking to know how to prevent foreclosure in Texas.

2. Forbearance Agreements

A forbearance arrangement temporarily suspends your mortgage payments, allowing you to get back on your financial feet. While it does not decrease your overall debt, it can stop instantaneous foreclosure action from taking place. This is best utilized if you anticipate a brief increase in financial assistance or resolve your transient difficulty.

3. Repayment Plans

Repayment plans permit you to get behind payments caught up by tacking on part of the overdue amount onto your standard monthly payments. This slow and steady approach gets your account up to date without straining your finances. It is yet another realistic option for those in need of good information on how to prevent foreclosure in Texas.

4. Reinstatement

In some cases, you may be offered a short time frame—usually within 20 days of receiving a default notice—to settle all outstanding amounts and restore your loan. Satisfying these conditions halts the foreclosure process temporarily, allowing you to establish longer-term arrangements.

5. Alternative Options

You also have other options like selling your house through a short sale or taking a deed instead of foreclosure. A short sale is selling your property at a price less than what you owe and the lender canceling the remaining balance. A deed instead of foreclosure is when you voluntarily surrender the title to the lender to escape the lengthy foreclosure process. These may be a better option if retaining your house is no longer possible.

Last-Minute and Emergency Strategies

If you’re in the last phases of the foreclosure process and time is running out, immediate action is necessary. A bankruptcy filing can initiate an automatic stay, stopping foreclosure for a short while and giving precious time to investigate other alternatives. You might also opt for litigation if you believe that the foreclosure process was improperly conducted by your lender. Understanding how to prevent a foreclosure in Texas even in eleventh-hour situations calls for swift, firm action and sometimes expert legal advice.

Final Thoughts

Foreclosure is complicated, and you don’t have to go through it by yourself. Housing counselors, not-for-profit agencies, and foreclosure prevention hotlines (such as the HOPE™ Hotline) provide free counseling and information. Furthermore, meeting with an experienced foreclosure or bankruptcy attorney can assist in implementing strategies following your circumstances. Expert advice is instrumental in helping you take the most effective action and fully appreciate your rights when determining how to prevent foreclosure in Texas. Get A Reasonable Cash Home Offer Quickly! Need to sell your house quickly? We Buy Houses in El Paso for cash in your timeframe.

Call us anytime at 713-561-5162 or connect with us on our website and we’ll lay out all of your options for your specific situation.