Quick Answer: What Are Some Ways That Someone Can Save Money on Their Rent?

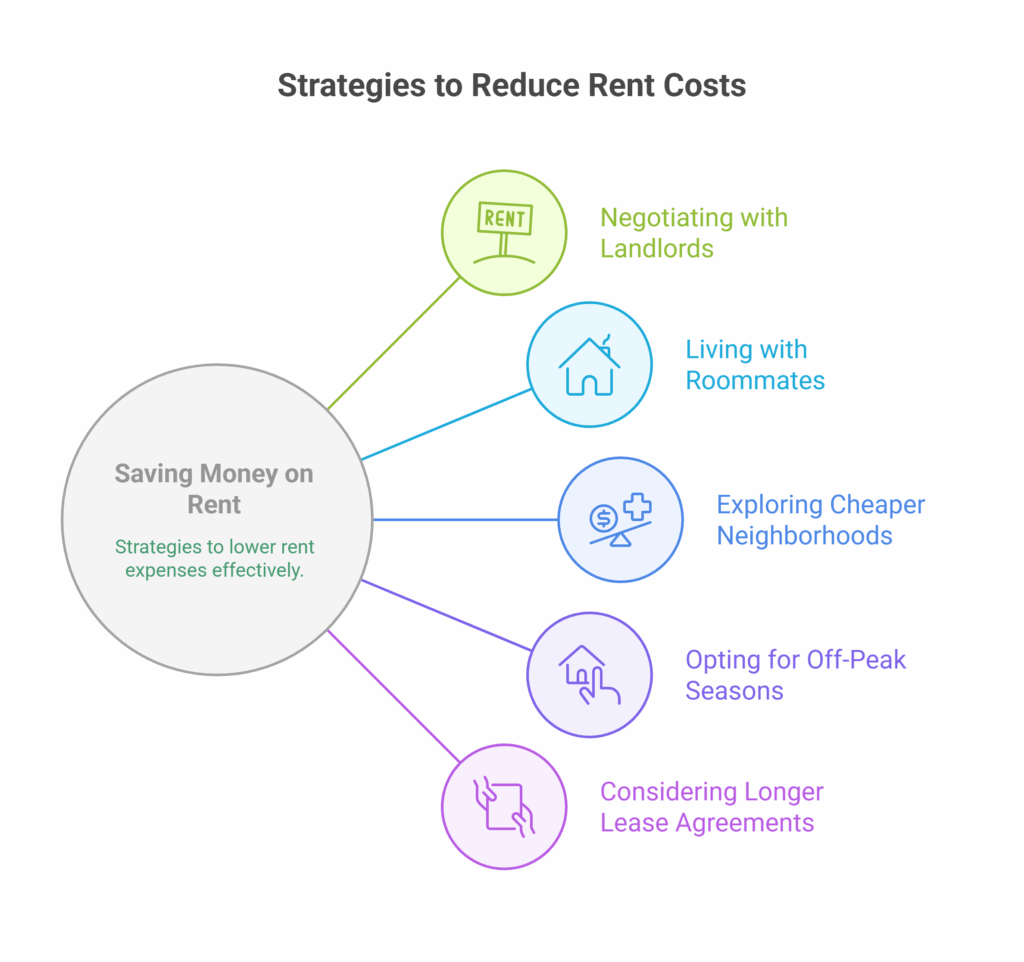

When people wonder, “What Are Some Ways That Someone Can Save Money on Their Rent?” the good news is there are several practical strategies that don’t involve moving into a shoebox. First, consider negotiating directly with your landlord—sometimes agreeing to a longer lease or paying early can open the door to small but meaningful discounts. Another smart approach is finding a roommate to split costs, especially if you’re renting in a high-demand area. Downsizing to a slightly smaller place or choosing a less trendy neighborhood can also significantly reduce monthly expenses without drastically changing your lifestyle. If relocation isn’t an option, you can look for ways to cut utility costs within your rental—like switching to energy-efficient appliances, negotiating for included utilities, or even offering to handle small maintenance tasks in exchange for lower rent. Subletting a room when you travel is another overlooked way to offset costs.

Ultimately, the answer to “What Are Some Ways That Someone Can Save Money on Their Rent?” lies in a mix of creativity, negotiation, and flexibility in housing choices.

1. Negotiate with Your Landlord

Many renters don’t realize that rent is often negotiable, especially in a competitive market or during off-peak seasons. If you’re renewing your lease or moving into a new apartment, don’t be afraid to ask for a discount, especially if:

- You have a solid rental history.

- You’re willing to sign a longer lease (e.g., 18 months).

- The unit has been vacant for a while.

- You’re paying several months upfront.

Make a polite but confident case. Emphasize your reliability and your willingness to stay long-term.

2. Consider Living with Roommates

Sharing your space is one of the easiest ways to cut your rent in half—or even more. This is particularly effective in urban areas where studios or one-bedroom apartments are costly.

Living with roommates can:

- Split not only rent but also utilities and internet.

- Allow you to afford a nicer place in a better location.

- Build a network of friends and support (if you choose the right housemates).

Use platforms like Roommates.com, Facebook groups, or even community boards to find someone you can trust.

3. Move to a More Affordable Neighborhood

Sometimes, the best way to save money is to move a few miles away. Living in a trendy downtown area might feel exciting, but it often comes with a hefty price tag. By moving to a slightly less popular (but still safe and accessible) neighborhood, you could save hundreds of dollars every month.

When researching new areas:

- Check public transportation options.

- Review crime statistics.

- Consider commute times.

- Look at future development plans that may increase the area’s appeal.

You might find hidden gems with affordable rent and a strong sense of community.

4. Offer to Do Work in Exchange for Lower Rent

Landlords love tenants who take initiative. If you have skills in maintenance, landscaping, painting, or even digital marketing, you might be able to offer your services in exchange for a rent reduction.

Examples of trade-offs include:

- Mowing the lawn or snow removal.

- Fixing small repairs around the building.

- Managing listings or social media if your landlord owns multiple properties.

Make sure to get any agreements in writing to avoid confusion later.

5. Look for Move-In Specials and Incentives

Many apartment complexes offer enticing deals to attract new tenants. These could include:

- First month rent-free.

- Discounted security deposit.

- Free parking or storage units.

Use websites like Apartments.com, Zillow, and Craigslist to find listings offering incentives. Signing a lease during winter months (November–February) may also get you a better deal since fewer people move during that time.

6. Sign a Longer Lease

While month-to-month leases offer flexibility, they often come at a premium. Landlords typically prefer long-term tenants because it reduces vacancy and turnover costs.

By signing a 12–24-month lease, you can often lock in a lower monthly rate. Plus, you’ll avoid sudden rent hikes for a longer period.

Just be sure you’re comfortable with the location and your job or life situation before committing.

7. Downsize Your Living Space

If you’re not using that second bedroom or rarely have guests in the extra-large living room, downsizing could significantly reduce your monthly expenses.

Consider moving into:

- A studio apartment.

- A smaller one-bedroom.

- A micro-unit in a co-living community.

Minimalist living not only saves money—it can also declutter your life and bring peace of mind.

8. Use Rent-Referral Programs

Some apartment complexes offer referral bonuses if you get friends or coworkers to move in. In return, you might receive:

- Rent discounts.

- Gift cards.

- Free upgrades.

Check with your leasing office or property manager to see if any such programs exist. This could turn into a win-win situation for both you and your referrals.

9. Look for Utilities-Included Deals

When comparing rent prices, don’t just look at the number. Some apartments include utilities like water, gas, electricity, trash, and even internet in the rent. These inclusions can save you $100–$300 a month.

Even if the rent is slightly higher, the total cost might be lower once you factor in bills.

10. Rent Out a Portion of Your Space

If allowed in your lease, you could consider subletting a room or even a couch on Airbnb (in areas where it’s legal). This can help you offset the cost of rent.

Make sure you:

- Get permission from your landlord.

- Understand local regulations.

- Take safety and insurance precautions.

This side income can go a long way in helping you meet financial goals.

11. Use Rent Payment Apps That Offer Cashback or Perks

Apps like Bilt Rewards let you pay rent and earn travel points or cashback. Some credit cards also let you pay rent with zero fees while earning rewards. Over time, these rewards can help offset other costs or be saved for future travel or emergencies.

Final Thoughts

Saving money on rent takes strategy, research, and sometimes a bit of negotiation. But with these methods, it’s more than possible to reduce your housing expenses and improve your financial flexibility. Keep your goals in mind, be willing to make a few compromises, and you’ll likely find that a more affordable lifestyle is well within reach.

When Renting Becomes Too Much…

Despite your best efforts, renting may still be unaffordable or no longer fit your lifestyle. In such cases, it might be time to reevaluate your housing altogether. If you’re a homeowner facing rising property taxes or struggling to afford your mortgage, you might consider downsizing or relocating to a more affordable market.

In El Paso, for instance, if you’re thinking “I need to sell my house fast El Paso TX“, working with a local homebuyer or real estate specialist can help you transition quickly. Whether you’re moving to a smaller rental or buying a more affordable property elsewhere, making a smart sale can ease financial pressure and open new doors.

Call us anytime at 713-561-5162 or connect with us on our website and we’ll lay out all of your options for your specific situation.