Quick Answer: What Is an Advantage of Renting a Place to Live?

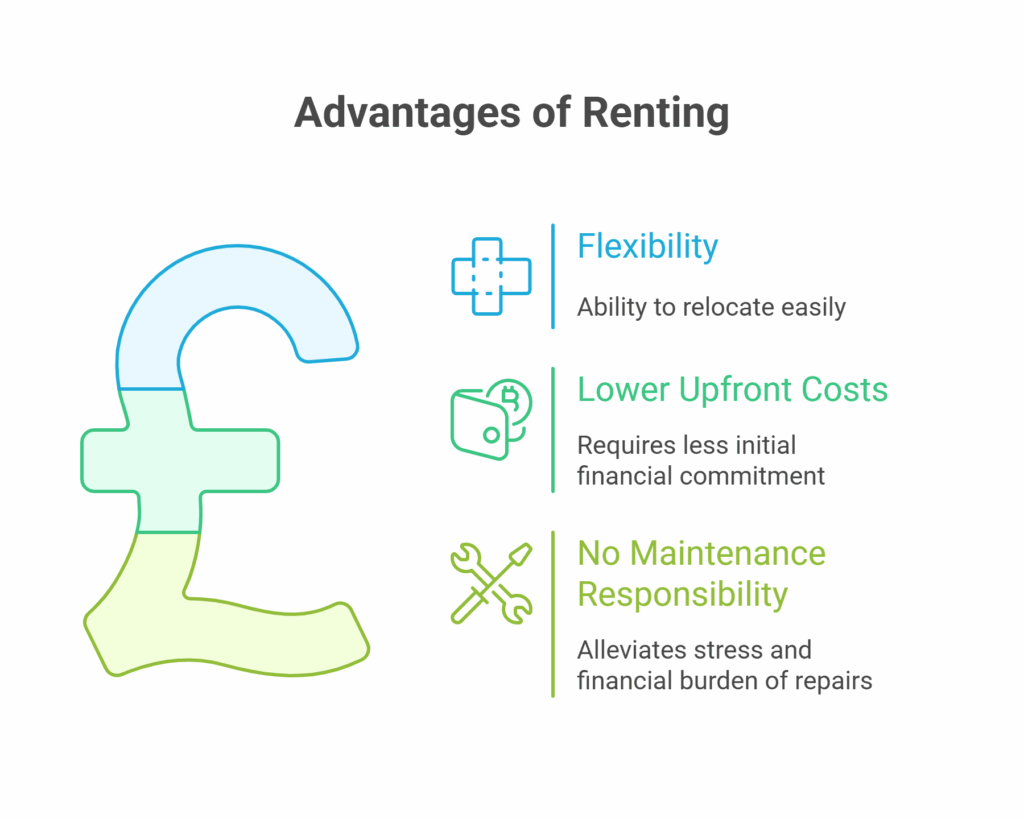

One clear answer to the question “What Is an Advantage of Renting a Place to Live?” is flexibility. Renting gives individuals the freedom to relocate without being tied down to a long-term mortgage, making it especially appealing for those with jobs or lifestyles that may require frequent moves. Another benefit is the reduced financial responsibility compared to owning a home—tenants usually don’t have to worry about paying for major repairs, property taxes, or maintenance, since these are typically handled by the landlord. Renting can also be more cost-effective in the short term, as it requires less upfront investment than purchasing property.

For young professionals, students, or families who are still exploring where they’d like to settle, renting provides a safe, affordable, and low-commitment option. Ultimately, when people ask “What Is an Advantage of Renting a Place to Live?” the answer often comes down to freedom of choice, lower stress about upkeep, and the ability to adjust living situations as life circumstances change.

1. Flexibility and Freedom

One of the most significant advantages of renting is flexibility. Renting gives you the ability to pick up and move with relatively short notice. Most leases run for 6 to 12 months, and once the term ends, you have the freedom to move to a new neighborhood, city, or even country.

This flexibility is especially appealing to:

- Young professionals who may receive job offers in new cities.

- Students who only need housing during their academic programs.

- Frequent travelers who prefer to live light and move often.

- People in transition, such as those going through a divorce or changing careers.

Unlike owning a home, renters aren’t tied down by property taxes, market fluctuations, or the daunting task of selling their home before relocating.

2. Lower Upfront Costs

Buying a home requires a substantial down payment, closing costs, property taxes, insurance, and sometimes private mortgage insurance (PMI). In contrast, renting typically only requires:

- First month’s rent

- Last month’s rent (in some cases)

- A refundable security deposit

This significantly lower financial barrier makes it easier for people to move into a rental property without wiping out their savings. If you’re focused on other financial goals like paying off student loans, saving for a business, or investing elsewhere, renting helps you keep liquidity.

3. No Maintenance Responsibilities

Let’s be honest—homeownership can be a full-time job. From mowing the lawn and fixing leaky faucets to handling HVAC repairs or roofing issues, maintenance can be expensive and time-consuming.

When you rent, the responsibility for repairs usually falls on the landlord or property management company. That means:

- No unexpected repair costs

- No need to vet contractors

- No weekends spent on DIY fixes

This is one of the most overlooked benefits of renting and a huge time-saver for those with demanding schedules.

4. Access to Amenities

Many rental properties—especially apartment complexes—come with built-in amenities that would be extremely expensive to replicate as a homeowner. These include:

- Swimming pools

- Fitness centers

- Dog parks

- Business centers or coworking spaces

- Security services

Having access to these without having to maintain or pay for them individually is a major perk. Imagine the cost of installing a pool or setting up a home gym—not to mention the ongoing upkeep.

5. Less Risk in a Volatile Market

Real estate is a long-term investment, but it can be affected by market downturns. If the housing market crashes, homeowners can lose equity and may find themselves owing more than their property is worth.

Renters, however, are shielded from this risk. They can move at the end of their lease without worrying about selling at a loss or being stuck with a mortgage on a depreciated asset.

What is an advantage of renting a place to live? It’s the freedom from financial risk during economic uncertainty—particularly important during times of inflation, recession, or market correction.

6. Easier Budgeting

Owning a home comes with unpredictable expenses: burst pipes, roof damage, HOA fees, property taxes, and insurance premiums that can go up year after year.

With renting, your costs are relatively predictable. You know exactly how much you’ll pay every month, and in some leases, utilities are even included. This makes budgeting easier, particularly for those who prefer financial stability and simplicity.

7. Location

Renting can give you access to better neighborhoods, school districts, or urban centers that might be out of reach if you were to buy. In high-cost cities like San Francisco, New York, or even parts of Austin, buying is prohibitively expensive for most people.

Renting in these areas lets you enjoy:

- Walkable communities

- Public transit options

- Cultural and dining hotspots

- Shorter commute times

You can enjoy a better lifestyle without the million-dollar mortgage.

8. Opportunity Cost of Homeownership

This one’s for the finance-minded folks. When you buy a home, you’re tying up capital in a relatively illiquid asset. That money could be used elsewhere—invested in stocks, a business, or even generating passive income.

Renting gives you the flexibility to use your money how you want. Rather than locking it into a down payment and repairs, you can focus on building a diverse portfolio, which might yield better returns in the long run.

9. No Property Tax Hassles

Depending on where you live, property taxes can add a significant cost to homeownership. In some states, property taxes alone can be thousands of dollars per year. As a renter, this isn’t your burden—it’s baked into the rent, and the landlord handles it.

10. Simpler Insurance Requirements

Homeowner’s insurance is typically more expensive and complicated than renter’s insurance. Renters only need to insure their personal belongings and liability, which is much cheaper and easier to manage.

Final Thoughts

In today’s ever-changing world, the traditional “American Dream” of homeownership doesn’t suit everyone’s lifestyle or financial goals. For many, the answer to what is an advantage of renting a place to live? is clear: it’s about freedom, flexibility, and fewer responsibilities.

Whether you’re focused on your career, avoiding financial entanglements, or just enjoy the simplicity of a maintenance-free lifestyle, renting can be a smart and strategic decision. It allows you to live where you want, how you want, and on your own terms.

And if you happen to be a property owner who’s considering offloading unused or inherited real estate while you rent stress-free, you might be wondering, “How can I sell my El Paso Texas land?” There are plenty of professionals and platforms that can help you turn that land into liquid capital—freeing you up to rent where you want and invest in what truly matters to you.

Call us anytime at 713-561-5162 or connect with us on our website and we’ll lay out all of your options for your specific situation.