Quick Answer: When Can You Sell Your House After Buying It?

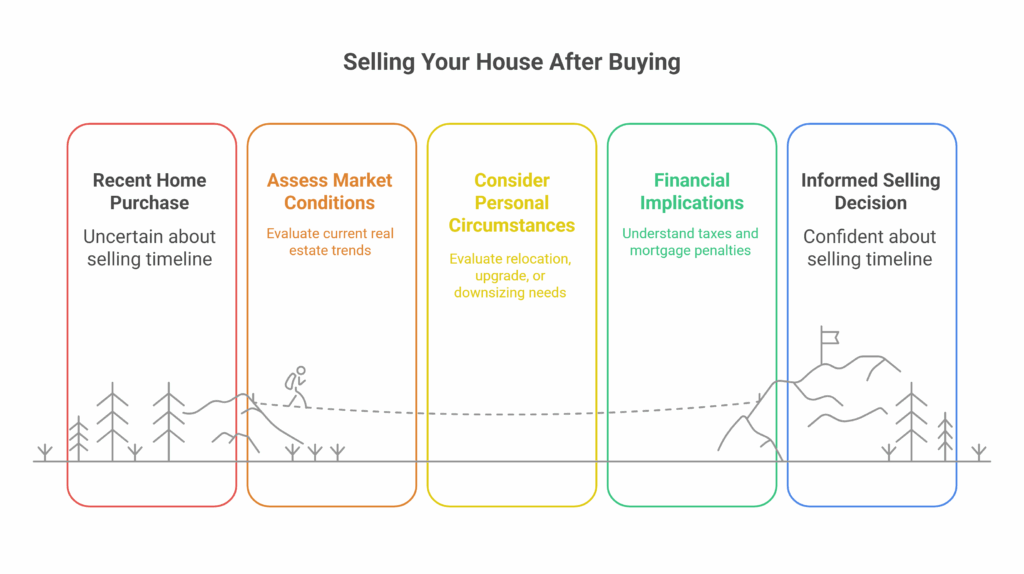

When Can You Sell Your House After Buying It? The answer depends on your financial goals, loan terms, and market conditions. Technically, you can sell your home the day after closing, but doing so may not always be wise.

Many lenders require you to live in the property for a certain period, especially with FHA or VA loans. Selling too soon could also trigger higher capital gains taxes and closing costs. In general, waiting at least two years helps you build equity, avoid extra taxes, and get better value when you decide to sell.

Now let’s dive deeper.

How Soon Can You Sell Your House After Buying It?

Technically, you can sell your house as soon as you legally own it. However, the decision to sell right after purchasing comes with potential consequences, such as financial losses due to closing costs, taxes, and mortgage penalties. Many homeowners wonder, when can you sell your house after buying it without incurring these losses? The answer largely depends on market conditions, personal financial stability, and mortgage terms.

Key Considerations Before Selling Your Home

1. Mortgage Prepayment Penalties

One of the first things to check before selling a home shortly after purchasing is whether your mortgage has prepayment penalties. Some lenders charge fees for paying off a mortgage early, particularly within the first few years of the loan. Be sure to review your loan agreement before making a decision.

2. Capital Gains Tax Implications

In the United States, selling a home within two years of purchasing may result in capital gains taxes on any profit made. To qualify for the capital gains tax exclusion, you typically need to have lived in the home as your primary residence for at least two out of the last five years. If you sell before this period, you may owe taxes on your profits, reducing your net earnings from the sale.

3. Closing Costs and Transaction Expenses

Selling a house involves significant costs, including realtor commissions (typically 5-6% of the sale price), title fees, and potential home repairs to make the property market ready. If you just bought your home, you may not have built enough equity to cover these expenses without financial loss.

When Can You Sell Your House After Buying It Without Losing Money?

1. After Building Enough Equity

Equity is the portion of your home’s value that you actually own, and it grows as you pay down your mortgage and as property values appreciate. If you sell too soon, you might owe more on your mortgage than the home is worth, leading to a financial loss. Experts recommend waiting at least 3-5 years before selling to build sufficient equity.

2. When Market Conditions Favor Sellers

Selling during a seller’s market—when demand is high, and supply is low—can help you maximize your profit. Even if you’ve only owned the home for a short time, a hot market can allow you to sell at a premium, covering your costs and potentially making a profit.

3. After Avoiding Early Mortgage Payoff Penalties

If your mortgage has prepayment penalties, it’s best to wait until those fees no longer apply. This timeline varies by lender but is usually within the first 1-3 years of the loan.

Common Scenarios That Lead to Early Home Sales

1. Job Relocation

A job opportunity in another city or state can make it necessary to sell a home soon after purchasing it. In such cases, homeowners may need to assess their financial situation to determine if renting out the property instead of selling is a better option.

2. Financial Hardship

Unexpected financial challenges, such as job loss, medical expenses, or changes in income, can make it difficult to keep up with mortgage payments, prompting an early sale. Homeowners facing this situation should explore options like refinancing or negotiating with their lender before selling at a loss.

3. Life Changes

Divorce, family expansion, or other personal circumstances may require homeowners to move sooner than planned. Selling a home early in these cases can be challenging but may be necessary.

Alternatives to Selling Your Home Too Soon

If you’re wondering, when can you sell your house after buying it but are concerned about potential financial losses, consider these alternatives:

- Renting It Out – If market conditions aren’t favourable, renting out your home may allow you to cover your mortgage payments while waiting for a better time to sell.

- Refinancing – If high mortgage payments are an issue, refinancing your loan could help lower monthly costs, making it easier to hold onto the property.

- Lease-to-Own Agreements – Some buyers may be interested in lease-to-own options, allowing you to sell the home later while still generating rental income.

Final Thoughts

While there is no legal restriction on when you can sell your house after buying it, financial and market factors should guide your decision. Ideally, waiting at least 3-5 years allows you to build equity and avoid capital gains taxes. However, if circumstances force an earlier sale—whether it’s your home or you’re looking to sell my El Paso Texas land—assessing mortgage penalties, transaction costs, and market conditions can help minimize losses.

Before making any decisions, consult with a real estate professional or financial advisor to understand the full implications of selling your property early. Ultimately, ensuring that you sell at the right time can help you maximize your investment and avoid unnecessary financial setbacks.

Call us anytime at 713-561-5162 or connect with us on our website and we’ll lay out all of your options for your specific situation.